Micro, small, and medium enterprises (MSMEs) are the backbone of Asian economies, accounting for the vast share of total establishments and total employment. However, MSMEs have suffered disproportionately during sudden economic shocks, as illustrated by the coronavirus disease (COVID-19) pandemic.

Many studies have attempted to quantify these adverse impacts. For example, a survey conducted by the Asian Development Bank Institute found that Pakistan and Viet Nam suffered the most on job losses, with respondents reporting losing over 60% and 80% of permanent and temporary employees respectively when the pandemic broke. The same research also found that MSMEs in Bangladesh experienced the severest liquidity crunch, with half of surveyed MSMEs experiencing both cash shortage and temporary shutdowns. The importance of MSMEs hence set many countries back considerably in their fight against poverty and inequality.

While governments have expended resources to support MSMEs, there are many examples where support failed to meet targets due to design flaws, lack of coverage, and slow product or service rollout. The coverage issue is compounded by the fact that many regional MSMEs are informal—and unregistered entities are unable to access these resources. For those able to access support, relief was often temporary and many eventually succumbed as the pandemic dragged on.

It is clear a band-aid strategy to support MSMEs during crises is insufficient, and that policymakers need to deploy a more comprehensive approach to strengthen the overall resiliency of small businesses—one that targets the fundamental challenges that they face during business-as-usual. The high relative economic risk exposure of the region fuels the urgency for such an approach. Given its location in the biodiversity-rich tropics and an additional 70 million people expected to live in its urban areas between 2015 and 2025, Southeast Asia is particularly susceptible to future pandemics. This is based on AlphaBeta’s analysis of statistics from the United Nations Population Division on urban population in Southeast Asian economies.

Comprehensive framework on MSME resilience to shocks

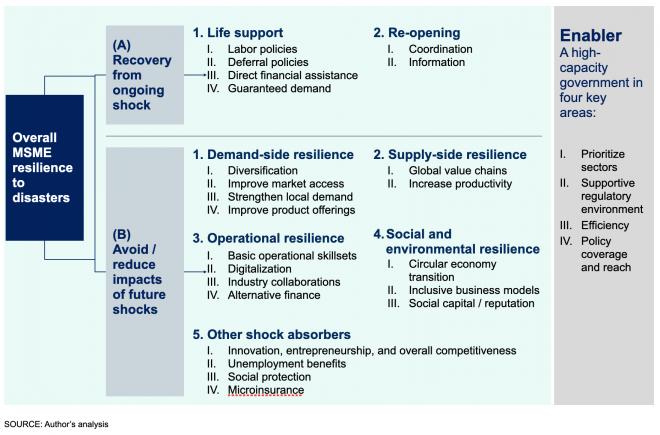

Resilience refers to the ability to recover quickly from a shock, such as a disaster, as well as the ability to withstand or limit the negative impacts of future crises. Drawing from our experience with both private and public sector stakeholders, both before and during the pandemic, we have identified a range of factors that are critical to strengthening MSME resiliency.

We propose a comprehensive framework to help MSMEs. The framework has two overarching components. The first includes the typical response policies to aid MSMEs during an ongoing shock or crisis. The second targets structural improvements to avoid or reduce the impacts of future shocks. Figure 1 illustrates these factors for easy reference.

Figure 1: Proposed framework for MSME resilience

(a) Recovery from ongoing shocks

- Life-support measures. These are shorter-term policies typically taken during a disaster. For instance, by the end of 2020, more than $420 billion were spent in Southeast Asia to address the COVID-19 pandemic. For MSMEs, these measures may include:

- Labor policies to help minimize job losses, ranging from wage sharing or subsidy models to job-matching initiatives.

- Deferral policies, which include the deferral of corporate tax, social security payments, debt payments, and rent and utility payments to ease immediate cash-flow issues.

- Direct financial assistance, including providing cheap bridging loans through the public banking system, or risk sharing with private banks to expand MSME credit, or direct subsidies and grants.

- Reopening measures. These include a range of policies to facilitate reopening, particularly during disasters when mobility is restricted. While the specifics will differ based on the nature of the shock and the industry, they broadly include:

- Coordination support. MSMEs tend to be constrained both financially and operationally and these could be exacerbated during disasters. Coordination support may include temporary relief in regulations, such as import–export requirements, or assistance from government agencies to help MSMEs comply with regulations, such as health reporting during a crisis.

- Informational support. Supporting MSMEs to reduce asymmetries, such as those linked to markets and prices, may be addressed by providing businesses with information on demand and supply and price discovery.

(b) Avoid or reduce impacts of future shocks

- Demand-side resilience. A key imbalance that many MSMEs face is the lack of diversity on the demand side. Take ASEAN’s tourism sector, which is dominated by MSMEs that overly rely on international tourism and limited tourist sources and destinations. In Thailand, international tourists account for 60% of the sector. Many countries in the region also rely on tourists from a few countries like the People’s Republic of China. In Indonesia, tourists converge mostly on Bali and Jakarta. Anecdotal evidence has shown that MSMEs with the most imbalances were worst hit during the current pandemic, while those that are able to pivot and serve local tourists, for example, are more likely to survive.

- Supply-side resilience. This entails diversifying MSMEs’ local supply chains to give them more flexibility during future crises. MSMEs also need to improve their productivity and ensure their workforce can adapt to the shocks by learning new skills and technologies.

- Operational resilience. Addressing capacity, technical, and financial constraints can reduce MSMEs’ vulnerability to future shocks. These include:

- Basic operational skillsets. Building basic skills on inventory management and book-keeping, often lacking in MSMEs, can help firms respond better during shocks.

- Digitalization. Shifting to digital platforms could support business continuity in times of pandemics or climate-linked disasters where physical interaction is impeded, especially for industries in the services sector.

- Industry collaborations. Industry bodies may consider forming strategic alliances to improve information collection and sharing through the mapping of raw material suppliers to reduce disruptions and keep costs down during supply shocks.

- Alternative financing. Increasing the number of and access to financing options are needed, while also ensuring that MSMEs do not face sudden liquidity crunches during crises.

- Social and environmental resilience. MSMEs need to be aware that trends such as the increased focus by customers, governments, and investors on environmental, social, and governance metrics do not only apply to larger firms. Strengthening social and environmental resilience by “doing the right thing” can build social capital and reputation which can strengthen a firm’s resiliency. Supporting MSMEs’ transition toward a circular economy is key given evidence firms that are more resource-efficient and -resilient enjoy better economic outcomes.

- Other shock absorbers. Several shock absorbers are also useful to promote resilience in the MSME sector. First, a highly entrepreneurial and innovative MSME ecosystem is more resilient as workers are more adaptive to changing circumstances. Linked to this is research showing that well-designed unemployment benefits may encourage risk taking and entrepreneurship in the MSME workforce. Next, social protection policies—beyond social protection but also includes labor market programs such as retraining—help to promote more efficient labor markets. For instance, having appropriate skills development and retraining programs will create conditions for workers to move across industries. This is particularly helpful for MSMEs who bear the brunt of labor demand–supply mismatches during crises. Third, making microinsurance accessible to MSMEs can also help firms bounce back in times of disasters, such as dealing with property damage after a typhoon. On many occasions, MSMEs are either unaware of the importance of insurance, or do not have financial means to get insured.

Finally, a high-capacity government is a critical enabler to ensure resilience among MSMEs. Governments should:

- Prioritize sectors for support;

- Develop a supportive regulatory environment that will help MSMEs thrive and be more flexible by easing and streamlining import–export rules, business registration, and certifications, such as Good Manufacturing Practices/Good Agricultural Practices, among others;

- Improve coordination on implementing programs as MSME policies can cut across many ministries and government agencies. One example is to establish permanent crisis management task-forces with multi-stakeholder representation. For instance, Greece announced that its Committee for Crisis Management will remain in place beyond COVID-19; and

- Widen the coverage of MSME policies to maximize access of target groups, including women and minority-led MSMEs, and prevent leakages.

The pandemic has caught many policymakers and MSMEs by surprise and reinforced the need to raise awareness on actions needed to ensure that small businesses are more adequately prepared for future shocks.

The proposed framework was borne out of the realization that reactionary policies to support small businesses during crises is an important but insufficient condition to promote a healthy and resilient MSME ecosystem. Promoting structural improvements in the MSME sector has the twin benefit of limiting the downside of future crises and disasters, while also reducing the fiscal hits that governments incur during these shocks. Furthermore, structural improvements should be holistic, as a piecemeal approach is unlikely to be sufficient.

Building the sector’s resiliency will also require commitment from both private and public actors. MSMEs may use this framework as a point of reference to guide their strategic decisions to build institutional strength—to be more resilient and sustainable.

As a first step, policymakers may use this framework to develop high-level guidelines to steer specific policy design, such that measures could be in place to promote MSME resilience before, during, and after a crisis, or disaster.

Bingxun Seng

Bingxun Seng

Principal, AlphaBeta

Bingxun Seng is an experienced economist and expert on Southeast Asian economies. He leads the public sector and economic development work of AlphaBeta, a Singapore-based economic strategy firm. He collaborates with the private sector, governments, multilaterals, and nongovernment organizations to address critical topics, including growth strategies, labor force transformations, socioeconomic development, regional integration, and public finance management.