This article was first published by Tech for Impact on 26 June 2020.

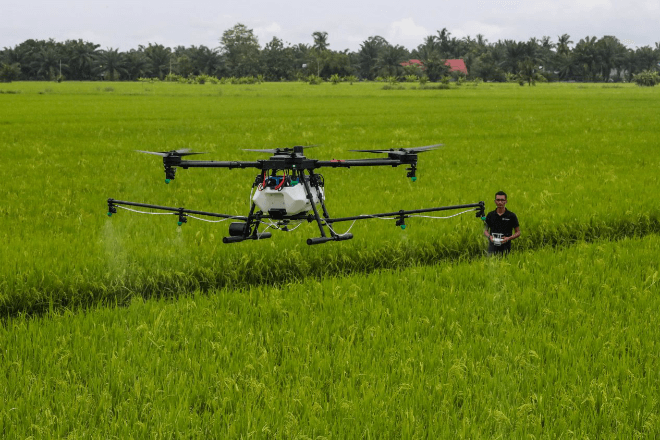

Drones are now doing a lot more than dropping bombs and shooting video. A new generation of programmable, autonomous drones has arrived, and it’s powering an agritech revolution in Asia.

Sabah Softwoods, a tree plantation in Malaysia, is using smart drone tech to kill weeds in its vast timber woodlands. It bought a custom drone from Malaysia-based enterprise Poladrone to spray weeds so that soon this task can be automated, and their staff won’t have to do it.

“Spraying chemicals by hand is slow,” says Sabah Softwoods Survey and Mapping Manager Albert Ku. “Especially on challenging terrain.”

Depending on the landscape and crop, it can take a worker all day to spray 0.65 acres of farmland with pesticides. A drone can perform this same task in just 2 minutes. Using drones also means that farmhands don’t need to come into direct contact with pesticides and other chemicals, a practice that a recent study found left 70% of farm workers with symptoms of acute pesticide poisoning.

Ku says the company might purchase a second drone system from Poladrone that’s capable of spot-spraying diseased trees.

Other farms in Asia now use drones to optimize crop watering and increase yield per acre. Drone sensors pick up data and run it through machine-learning algorithms, giving farmers valuable operational insights. Many modern agricultural drones don’t even need a trained pilot; they can be programmed to follow preset flight patterns, and they can use cloud-based management software to make in-flight adjustments as needed.

All of this lets farmers spend fewer hours in the field and decreases reliance on inefficient legacy tech, such as gas-guzzling tractors.

These operational upgrades are a no-brainer for big plantations with capital—however, most farms aren’t big plantations. It’s the “small farms” (those that grow between $1,000 and $250,000 of agricultural products per year) that make up more than 75% of the world’s farmland. Many small farmers simply can’t afford an agricultural drone, which can cost from $1,000 to $25,000.

But JX Cheong, CEO of Poladrone, believes that the cost of this tech shouldn’t be a barrier for small farmers. “If [small farmers] only have a couple hectares of land, it might not make sense for them to invest in the technology, says Cheong. “We work instead with the corporations. They invest in the technology, and Poladrone trains a member of the corporation to use the drone.”

The corporations then share their knowledge with small farmer cooperatives, and provide farmers with opportunities to use drones on their land.

As governments in ASEAN work to expand farming cooperatives to include more small farmers, Poladrone and other drone companies will have the chance to work with these cooperatives to scale drone tech into more small farms.

But for this concept to be actualized throughout the region, commercial drone regulations need to change. In Viet Nam, for example, drones are subject to the same laws as airplanes, and this January the government actually tightened restrictions on drones. Meanwhile, the Philippines has a lengthy list of restrictions on commercial drone permits.

Cheong believes that governments will alter regulations as drone adoption increases, but he doesn’t expect serious changes in these countries for another 2 to 3 years.

Until then, drone companies will work to refine their tech in the markets that are open to them—and they will have ample opportunities to prove their drones are a boon for efficiency.

“Drones will play a major role in agriculture within the next decade,” says Ku of Sabah Softwoods. “That’s why we are adopting this technology now.”

This article was authored by Ben Engelbach.