The Green, Social, Sustainable and Other Labeled (GSS+) Bonds Initiative for Southeast Asia

Download (897.71 KB)

Download (897.71 KB)

Publication Type:

Publisher:

Asian Development Bank (ADB)

Publication:

December 2022

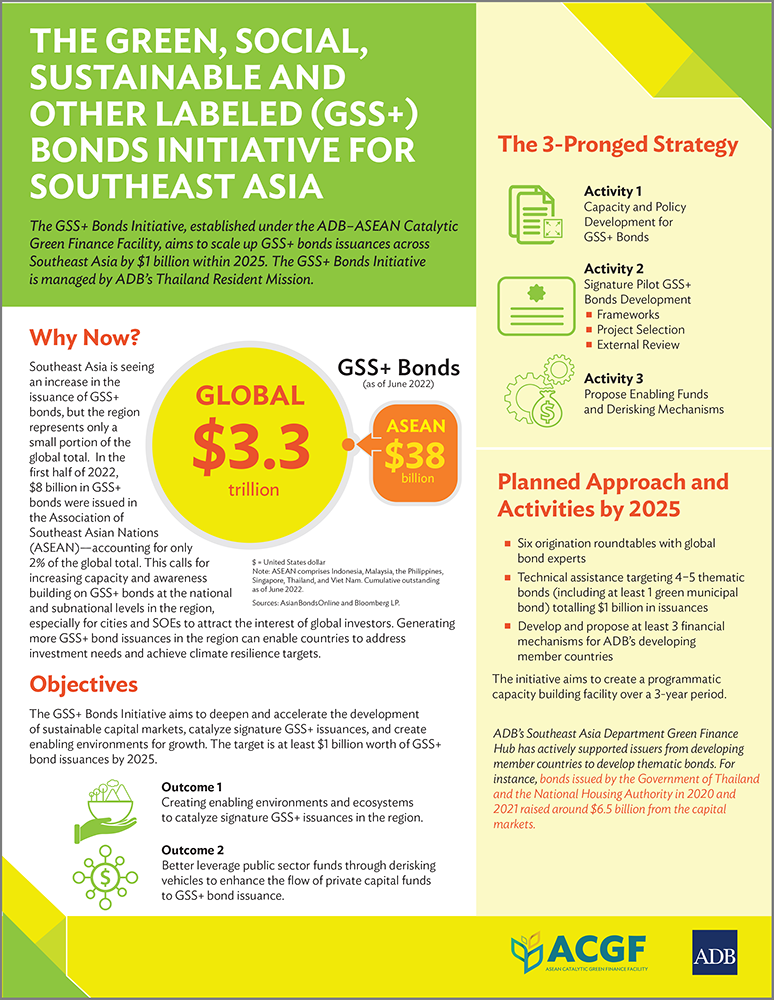

This flyer explains how Southeast Asian debt issuers could raise over $1 billion by 2025 through green, social, sustainable, and other labeled bonds to finance climate investments.

The Asian Development Bank (ADB) launched the Green, Social, Sustainable and Other Labeled (GSS+) Bonds Initiative to deepen and accelerate the development of sustainable capital markets, catalyze signature GSS+ issuances, and create enabling environments for growth. The target is at least $1 billion worth of GSS+ bond issuances by 2025.

This flyer explains how Southeast Asian debt issuers could raise over a $1 billion by 2025 through green, social, sustainable, and other labeled bonds to fund investments and ramp up climate resilience.

Calculating ASEAN members issued just 2% of the $8 billion in global GSS+ bonds in the first half of 2022, the flyer underscores how increasing capacity and awareness could lead to a jump in sustainable debt from the region.