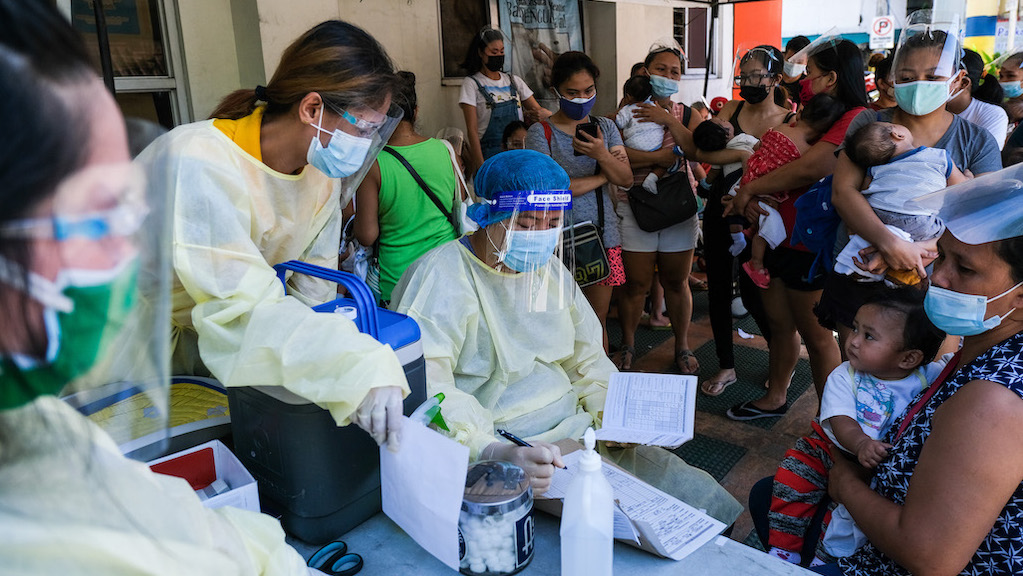

Fintech solutions can be powerful in helping long-excluded low- and middle-income populations gain access to healthcare and buttress them against health-related bankruptcy. Photo credit: ADB.

Using fintech can help ease the financial and health burden of individuals and help improve health systems and outcomes, says a new ADB report.

With medical costs driving 65 million people to poverty every year in Southeast Asia, widening access to healthcare is a priority.

Providing quality and affordable healthcare for all, however, entails facing major challenges. Medical needs—and their costs—have been sharply rising with the increasing prevalence of noncommunicable diseases due to longer life expectancies and lifestyle and diet changes. The rate of medical inflation currently stands at 8%, compared with an average inflation of 2% for general goods and services.

Using innovations like financial technology or fintech is one of the ways to ease the financial and health burden of individuals and their families and help improve health systems and outcomes, according to a new report from the Asian Development Bank (ADB).

The report, Leveraging Fintech to Expand Digital Health in Indonesia, the Philippines, and Singapore: Lessons for Asia and the Pacific, says an approach that integrates digital financial services with health innovations can help solve healthcare affordability, quality, and access challenges. This approach “can be powerful in helping long-excluded low- and middle-income populations gain access to healthcare and buttress them against health-related bankruptcy,” the report says.

Digitalization reduces costs related to the tracking and receipt of cash-based payments, the report says. It saves providers and payers human resources and administrative costs, provides a transparent financial record, and allows for integration with other digital platforms. Digital payments also allow for substantial transparency and digital records that reduce the likelihood of fraud or misuse.

As such, having a “fintech for health” approach can enable access to health-care financing, information, and services, as well as improve overall operational efficiencies of health system, the report says, noting such an approach needs a foundation of clear, enforceable regulations and policies; equitable and mature digital connectivity; and a thriving innovation ecosystem.

Serving vulnerable groups

In recent years, digital financial services have helped to bring critical access to financing for underbanked and unbanked populations.

Mobile money, e-wallets, and peer-to-peer transfers used to transfer and manage money help patients directly pay for clinical care, insurance premiums, and health-care products. Patients can even combine digital payments with savings and lending products.

People who depend on remittances from their families abroad now have the option of having the money stored in a health e-wallet or paid to hospitals directly.

There are also payment gateways and aggregators that provide solutions to accept, authorize, and process payments on digital platforms, such as telehealth platforms, or that serve as a mechanism to contribute to health wallets.

Mobile point of sales (mPOS) and point of sales (POS) terminals may be used for card-based payments, storage of health information, and recording of services received at clinics, hospitals, and pharmacies.

Fintech solutions

The report identified key digital financial service technologies that can benefit healthcare patients, payers, and providers.

For patients. Financial service technologies for patients include digital savings, digital credit and lending, digital insurance or insurtech, and crowdfunding.

Digital savings accounts simplify savings management and expenditures. In some countries, health savings accounts have served as a simple, easy-to-understand health financing tool that leads consumers along a user journey to more sophisticated health financing products.

Digital credit and lending include balance sheet consumer lending, whereby the platform company assumes the risk, and peer-to-peer consumer lending, whereby the platform connects lenders and consumers. Combined with alternative risk scoring, ethical, low-cost digital lending solutions offer unbanked or underbanked patients a trusted, transparent source of funds to pay for unexpected or expensive healthcare and manage household funds better.

Digital insurance or insurtech is a term to describe any insurance product that is applied for, purchased, claimed against, or reimbursed digitally. Insurtech platforms allow patients to make informed decisions, determine their eligibility, and enroll online, while enabling companies to create tailored insurance plans for target markets. Fintech also creates efficiencies by connecting providers and payers for more seamless claims and reimbursement processes and data visibility.

Donations-based crowdfunding comprises platforms through which donors provide financial assistance directly to patients to cover high healthcare costs. Crowdfunding campaigns often use social media platforms to solicit donations and can be combined with peer-to-peer insurance for greater reach.

For payers. Payers, which include both public and private insurance providers, use digital technologies to optimize the allocation and use of resources, introduce efficiencies, and eliminate fraudulent claims. These include enterprise financial management platforms, which help remove significant human resource costs and legacy administration processes. Through digitalization, payers can streamline processes, capture and analyze data for underwriting, and gain insights on opportunities for cost savings. These savings can be passed on to the consumer, thus lowering the cost of care.

Payers also use insurtech platforms, which have the potential to improve how public and private insurance programs operate. National insurers can employ automated claims processing and reduce the opportunity for human errors, save staff costs, and ensure payments are made on time to providers and patients alike. Through digital identification and fraud detection technologies, insurtech platforms can reduce the amount of public funding lost to insurance leakage. They provide better payment and information exchange between payers, providers, and national insurers, thereby increasing overall transparency and satisfaction with national insurance programs.

For providers. Healthcare providers, whether small community clinics or major tertiary hospitals, seek to balance and ensure the delivery of high-quality care for their patients while remaining operationally and financially sustainable. Providers often struggle to access credit for the upgrading of facilities and for working capital, and to purchase new equipment. Digital lending, either through loans or through cash advances, offers providers the means to invest in improving the quality of services, pay staff, and ensure that essential medicines are in stock.

Providers also use enterprise financial management platforms, such as e-invoicing, digital accounting, digital payment collection, and business intelligence platforms, which provide greater efficiency, transparency, and sustainability for users. They reduce the administrative burden of cash-based payments and accounting, ensure that accounts are up to date, reduce financial leakages, track payments received, and provide improved visibility on business performance. The resulting cost savings can be invested into the provision of healthcare services, thus improving the quality and capacity of care.

Insurtech solutions provide convenience to providers by determining patient eligibility and coverage status at the point-of-care, streamlined data sharing and administrative processes with payers, and faster reimbursement when claims are filed directly from healthcare providers to payers. Additionally, when insurtech leads to increased financial protection and understanding of benefits, lower- and middle-income patients are more likely to access care, thereby increasing provider revenue.

Country examples

In examining the enabling environment and examples of a fintech for health approach in Indonesia, the Philippines, and Singapore, the report notes differing health system contexts, digital maturity and adoption, and needs of these countries, which highlight the variety of challenges this approach can face.

In Indonesia, the health social security agency launched Jaminan Kesehatan Nasional (JKN) Mobile in 2017 to digitalize the national health system to serve all citizens. The JKN Mobile system allows users to locate nearby health facilities, receive tailored health information, and check their hospital invoices and payments. The system has greatly improved access to healthcare facilities amid COVID-19 restrictions. Patients can queue for health facilities online.

Indonesian superapp GoJek offers the Halodoc telemedicine service. Halodoc integrates primary care services, e-pharmacy services, and an online-to-offline healthcare experience with cashless visits. It also has a feature that facilitates insurance claims.

In the Philippines, Medifi is an online health consultation service that allows digital payments using the patient’s credit or debit card. It has more than 3,000 doctors available for online consultations. Patients pay a flat rate of $14 for general physicians and custom rates for specialist doctors. The online platform also facilitates digital prescriptions, lab tests, and medical certificates.

Singapore’s Oversea-Chinese Banking Corporation (OCBC) offers the HealthPass by OCBC app. The mobile app provides telehealth services from more than 150 general practitioners and specialist doctors. The services are available to Singaporean residents over the age of 18. OCBC’s app provides access to primary care telehealth services, diagnostic procedures, and medication delivery. Patients pay a flat fee of around $74 for their first telehealth consultation or in-clinic visit, while subsequent consultations cost about $15.

Recommendations

To be able to take advantage of opportunities in the fintech for health space, the report recommended the following.

For regulators and policymakers:

- Pass legislation for a strong regulatory environment that enables innovation.

- Invest in equitable mobile connectivity.

- Require appropriate impact measurements.

- Empower patients with digital, financial, and health literacy.

- Infuse enthusiasm for cross-sector partnerships through regulatory sandboxes, fintech for universal health coverage, and a digital ecosystem for healthcare.

For fintech and digital health startups, investors, and government incubators:

- Adopt an equity lens for vulnerable and underserved groups.

- Invest in fintech for health market opportunities.

- Focus on the mutual achievement of financial inclusion and universal health coverage.

For multinational development banks and foundations:

- Commit long-term funding to a fintech for health agenda.

- Prioritize funds that strengthen the regulatory environment and digital maturity of developing countries.

- Require health impact measurements and an equity lens for infrastructure projects.

- Fund grants for fintech for health pilot projects that support developing countries' national insurance programs and overall universal health coverage goals.

- Provide technical assistance for governments to articulate fintech for health strategies.

This article was first published by BIMP-EAGA on 13 October 2022.

BIMP-EAGA

The Brunei Darussalam–Indonesia–Malaysia–Philippines East ASEAN Growth Area, or BIMP-EAGA, is a cooperation initiative established in 1994 to spur development in remote and less developed areas in the four participating Southeast Asian countries.