This Fintech Social Enterprise Leans on Low- and High-Tech Solutions to Help MSMEs Get Better Access to Credit

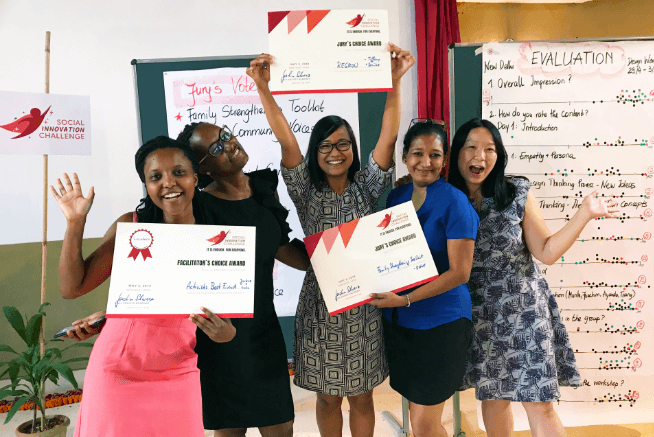

With micro-entrepreneurs as their target market, Aeloi designed their solution so that small business owners can get the loan through SMS. Photo credit: Courtesy of Aeloi.

Aeloi Technologies, the winner of ADB’s smart cities datathon, wants to help bridge the $8.1-trillion credit gap facing MSMEs worldwide.

Fintech startup Aeloi Technologies wants to help solve the $8.1-trillion credit gap problem facing micro, small-, and medium-sized enterprises (MSMEs) worldwide.

Thanks to its loan insight software solution, Aeloi bagged $20,000 in seed funding from the Asian Development Bank (ADB) for the recently concluded Smart Cities Datathon 2021—Building Back Smarter: Digital Solutions for Livable Cities. The startup bested more than 60 participating teams.

From low-tech to high-tech

Aeloi co-founders, Tiffany Tong, CEO, and Sonika Manandhar, chief technology officer, started the social enterprise in Nepal in 2018. Their approach uses a combination of low-tech and high-tech solutions to deliver affordable credit to MSMEs.

Under the system, business owners can get loans from banks in the form of digital tokens. The digital tokens are not currently based on blockchain technology, but Aeloi is now testing its blockchain system so it can have it up and running by the end of the year.

The digital tokens can only be used at vendors which are part of the Aeloi ecosystem, ensuring bank loans are used for business purposes. The vendors can redeem the digital tokens from the banks once the service or product is delivered.

With Aeloi, banks can monitor how the loans are spent, addressing one of the pain points of banks when it comes to lending to MSMEs. Aeloi eventually plans to deploy big data to provide detailed impact analysis to clients.

Ultimately, Aeloi envisions the audit function of the solution to lower banks' transaction costs, giving them the leeway to offer better credit terms to MSMEs.

Recognizing that small business owners may not have access to smartphones or the internet, the co-founders also designed their solution so that small business owners can get the loan through SMS. Aeloi also uses an interactive menu-based messaging technology that can be used even with older Nokia phones to make the solution accessible.

Securing credit

Coming from a family of immigrants, Tong knew first-hand how difficult it is for small business owners to secure credit. “I’m the third generation in my family that has been a migrant entrepreneur. My grandparents were refugees, my parents are immigrants. We have all had to set up new lives in new countries, so I’ve witnessed how important it is to have access to business credit. It can literally change the trajectory of a whole family to be able to use their skills and build a business.”

The financial industry is very biased toward micro-entrepreneurs at the grassroots level, she says, noting they would have difficulty meeting conventional financing requirements like employment proof, credit history, collateral, and even alternative credentials like education, smartphone usage, and behavioral tests. “With Aeloi, we wanted to try to re-imagine what better financial services can look like and use technology to scale and bring down costs,” she says.

Manandhar says technology has been a big help to Aeloi. “Without technology, we wouldn’t have accomplished what we’ve done so far.”

She notes the challenges of building an inclusive solution for users who are not technology savvy. Explaining what a digital token is to small business owners is in itself a challenge. As the chief technology officer, she felt like Aeloi's technology was easy to use, but out in the field she saw how the users found it complicated to navigate the system using phones, which run on Symbian, a discontinued mobile operating system. "Something as simple as finding an asterisk becomes a complicated task. We constantly explore possible alternatives to these technical problems.”

Fine-tuning the solution to meet the needs of small business owners, while also making sure the technology is sound and has multiple layers of security to meet the needs of their bank and vendor partners is one of the biggest challenges Aeloi has faced so far.

Aeloi continues to pilot the solution in Nepal and has won other innovation challenges for its efforts. It recently won one of the awards at the 2021 World Bank Group Youth Summit Social Innovation Challenge. It also received nods from the United Nations, the Civil Society Academy-Welthungerhilfe, National Geographic Society, and Standard Chartered.

Today, Nepal, tomorrow, the world

Aeloi works with four financial partners as well as savings and credit cooperatives in Nepal as part of its pilot. Aeloi, pronounced as alloy, is a nod to how the startup relies on its microfinance and micro-entrepreneur partners to provide a solution to the credit gap problem for MSMEs.

Manandhar says Aeloi is looking for more areas to expand its pilot. Winning the datathon, she says gives Aeloi the opportunity to work with ADB in expanding its pilot. "We are happy to do so regardless of the location or the country."

In Aeloi’s final pitch to the datathon judges, Tong says in the next few years, the startup plans to expand to two countries, targeting 10,000 users.

In 5 years, she says Aeloi will become an investment platform driven by big data with an accredited network of vendors, micro-entrepreneurs, financial institutions, and impact investors across emerging markets.

In 10 years, she envisions Aeloi becoming a blockchain security big data platform, which powers an ecosystem of services for micro-enterprises, including insurance, subsidy transfers, and skills trainings.

Joris G. Van Etten, senior urban development specialist at ADB, lauds Aeloi’s solution as well as those submitted by the other teams. He says all the submissions, in one way or another, provided ideas and solutions which could make life in cities more sustainable, enjoyable, and, in general, livable.

“The most exciting part of a datathon such as this one is that behind every submission there is a team of people who are genuinely keen to make a positive contribution and make cities more livable,” he says.

ADB originally planned to pick just one winner for the datathon. But when it announced the results, it also named Alaga Health, a digital health-care startup based in the Philippines, as runner-up. Alaga Health received $10,000 in seed money.

Four teams made it to the finals, including Aeloi and Alaga Health. The other two were Annapurna and Inter-GenZ. Annapurna develops financial access solutions, while Inter-GenZ offers resource-sharing solutions.

The datathon was organized under ADB’s ASEAN Australia Smart Cities Trust Fund, which was set up in 2019 to help Southeast Asian countries build livable cities that are green, competitive, inclusive, and resilient. Co-financed by the Australian government, the trust fund supports cities with capacity development assistance and partnerships. ADB manages the trust fund, which has $14 million in funding.