The Clock Is Ticking on Central Bank Digital Currencies: Are You Ready?

Global Central Bank Digital Currencies Lead, Visa

Digital currencies show great promise and have the potential to significantly impact global monetary policy. Photo credit: iStock/metamorworks.

Central banks are taking digital currencies more seriously. Here is how commercial banks can get ahead to make adoption a reality.

This story is published in collaboration with Visa.

Central bank digital currencies (CBDCs) are gaining traction around the world. The Sand Dollar is already available to all citizens of the Bahamas, Sweden’s e-krona project is well into the second phase of testing, and last summer, the European Central Bank launched a study of a digital euro project. And for good reason. Digital currencies show great promise and have the potential to significantly impact global monetary policy.

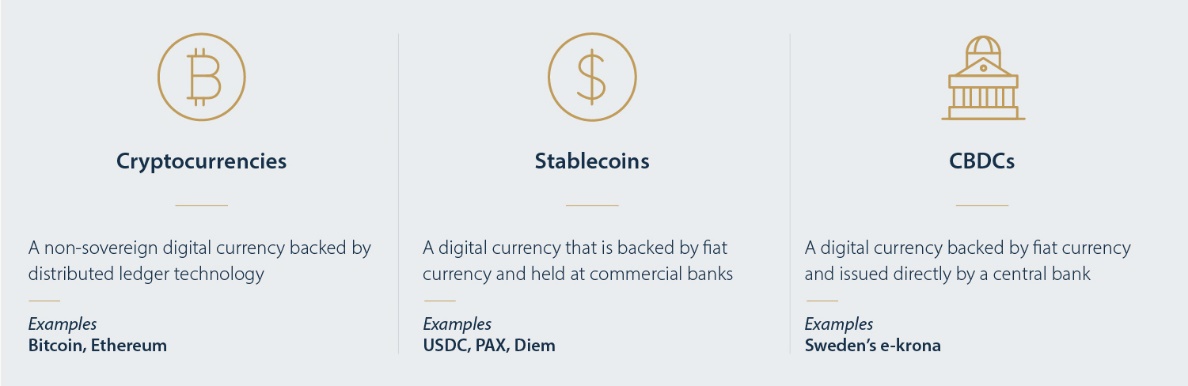

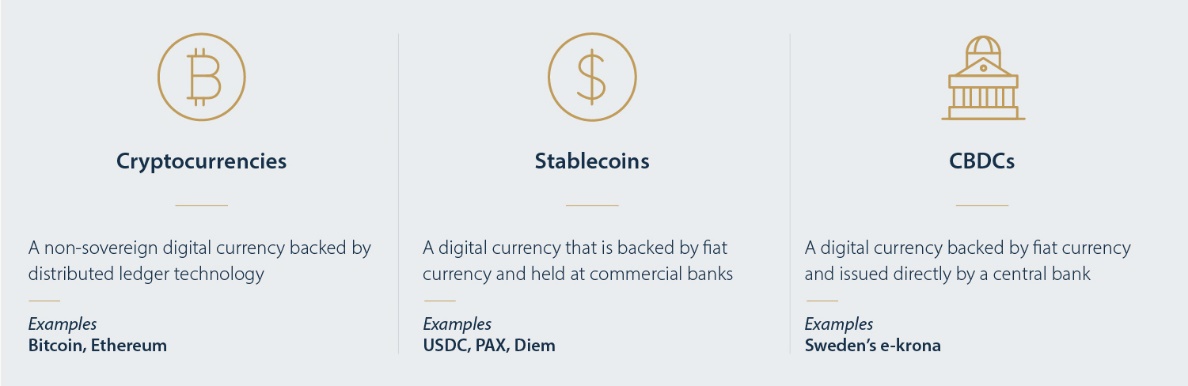

CBDC represents a digital form of cash issued by a central bank. While several countries have taken concrete steps to advance a CBDC framework, many central banks are still in the exploratory phase to understand the potential use cases of the new technology and the ways in which it can help complement, rather than replace, existing payment systems.

How do CBDCs work?

CBDCs are created by a central bank and designed based on a country’s unique policy objectives and motivations. For instance, CBDCs may be used in government disbursements where digital cash is distributed to those in need more quickly and directly. CBDCs may help address financial inclusion needs by enabling reach to unbanked or underbanked populations through a new means of payment and more accessible financial services. CBDCs may also expand a central bank’s set of tools to implement monetary policies and monitor economic activities more efficiently. Furthermore, CBDCs can be held within individuals’ digital wallets to ensure that citizens will have access to funds both online and offline.

For many, the appeal of government-backed “digital cash” may seem vague, given the wide availability of electronic payment methods and the array of digital tools available for managing all aspects of our financial lives. But while there is no “one-size-fits-all” technology in payments and banking, CBDCs can take on a variety of forms, whether retail, wholesale or general purpose.

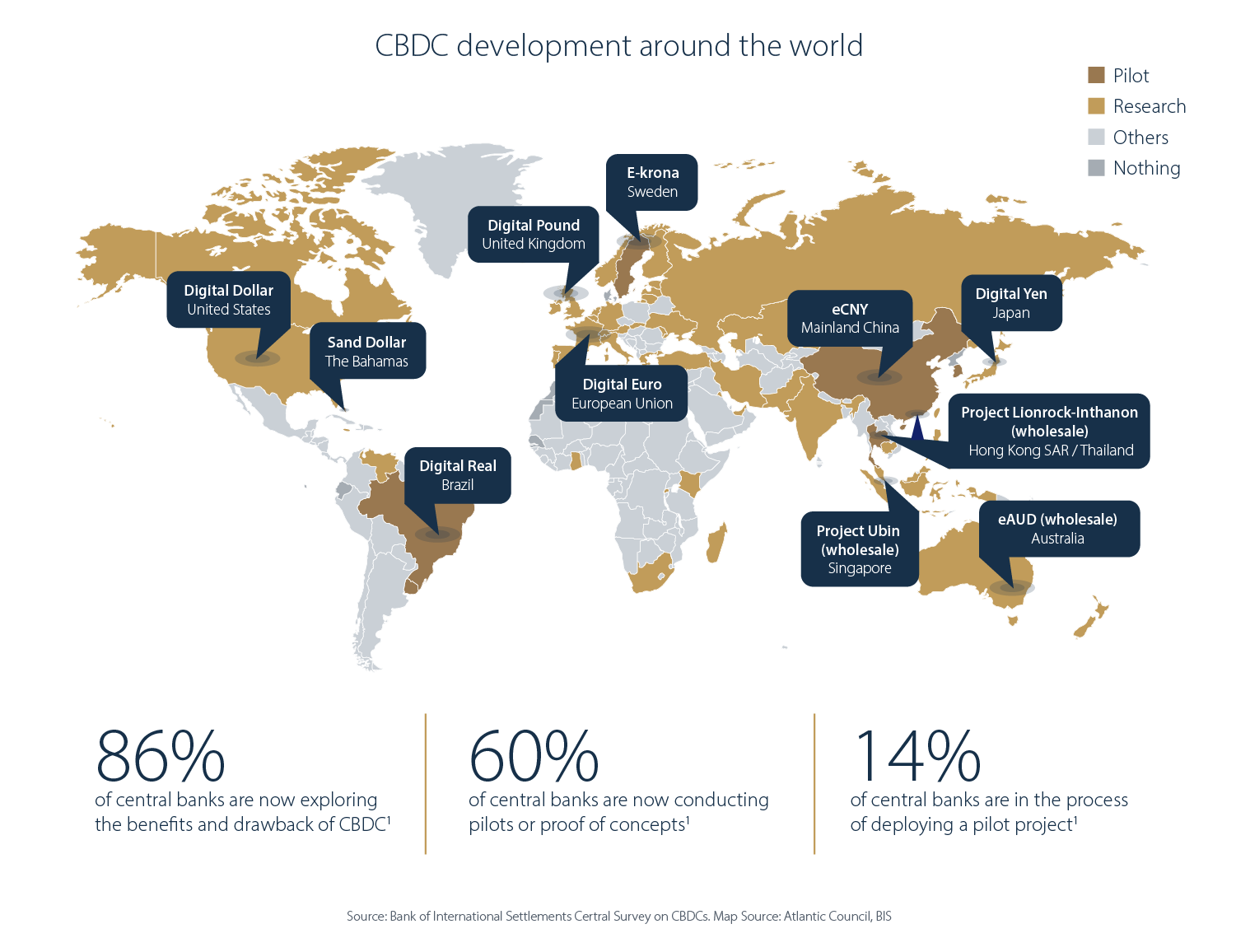

The state of CBDCs around the globe

Global interest in CBDCs from central banks has skyrocketed in recent years. A 2021 survey published by the Bank of International Settlements found that 86% of central banks are actively researching the potential for CBDCs, while 60% were experimenting with the concept, and 14% were in the process of deploying a pilot project. As of June 2021, the Sand Dollar Project in the Bahamas is already live, while Sweden’s e-krona project is leading the way when it comes to CBDC pilots.

The United States Federal Reserve is weighing the potential benefits and risks of issuing a digital dollar. “The design of a CBDC would raise important monetary policy, financial stability, consumer protection, legal, and privacy considerations and will require careful thought and analysis, including input from the public and elected officials,” stated Federal Reserve Chairman Jerome Powell in a May 2021 interview. Looking ahead, the US Fed is expected to release a report to evaluate the benefits and risks of CBDCs.

President of the European Central Bank, Christine Lagarde, announced in early 2021 that the EU is trying to launch a digital euro “within the next 4 years.” The Bank of England and HM Treasury has also jointly created a CBDC Taskforce to coordinate the exploration of a potential CBDC. Conversely in Canada, while the Bank of Canada is developing a cash-like digital currency, Deputy Governor Timothy Lane has stated that he does not see a strong case for issuing a CBDC at this point in time.

Preparing for a world of CBDCs

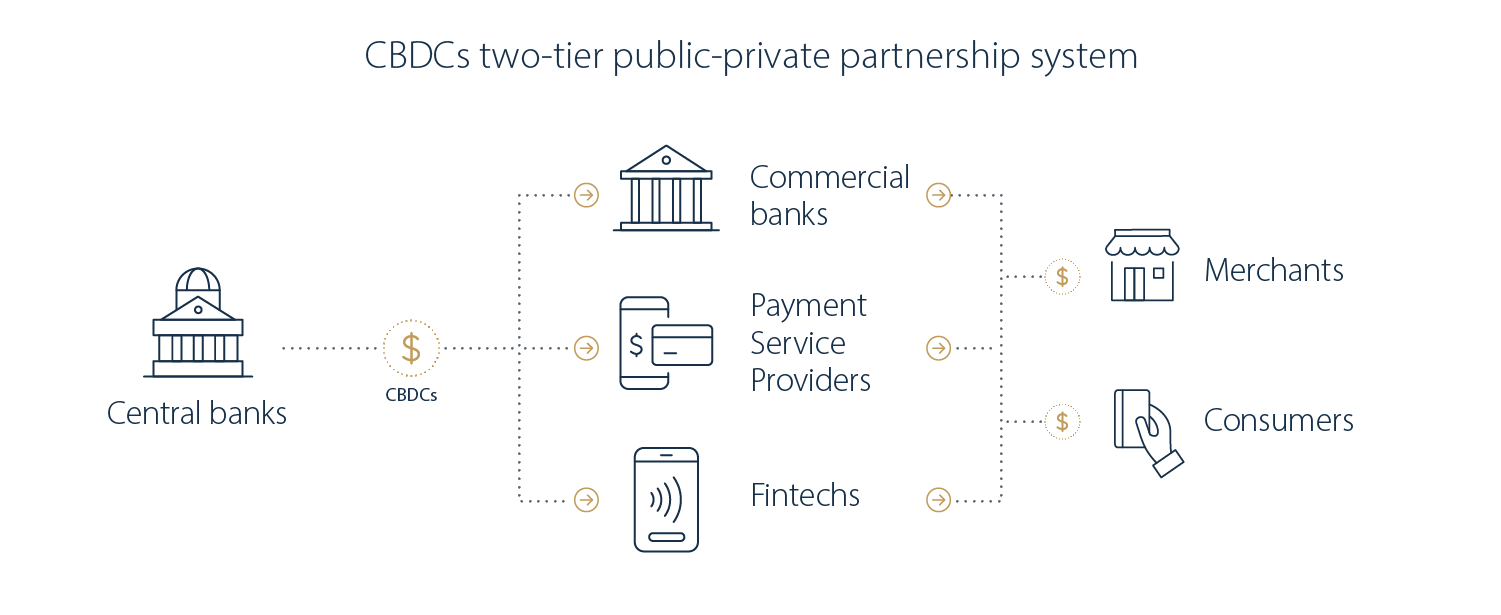

Ultimately, for CBDCs to be successfully integrated in the economy, public and private partners will need to draw upon their respective areas of expertise, distribution channels and responsibilities within the payments ecosystem. What might successful integration look like? A two-tier system design, in which central banks issue CBDCs to commercial banks, payment service providers, and fintechs, who are in turn responsible for distributing the digital currency and interfacing with consumers and merchants.

This model ensures that banks can maintain their existing relationships with their customers, to support clients and provide customer-facing services, while undertaking compliance checks, like KYC (know your customer) and AML (anti-money laundering). In the digital world, a two-tiered system can be implemented using public-key cryptography, which allows the central bank to outsource the complexity of managing digital certificates for CBDC tokens to a set of potentially regulated, permissioned entities.

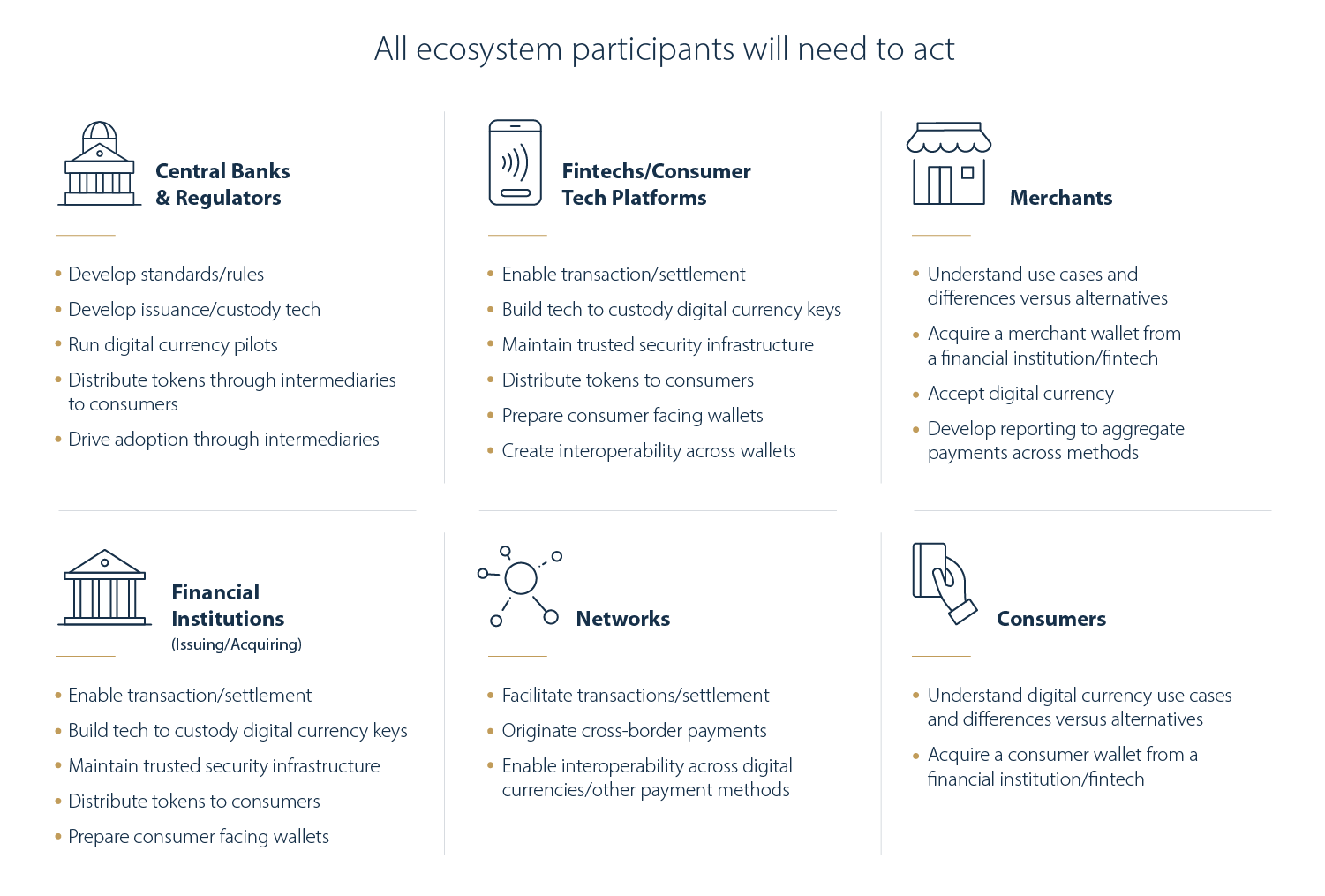

Innovation moves fast within the ecosystem. As new technologies reshape consumer behavior and open new opportunities to build products and services, financial institutions can start building their digital currency roadmap to:

- Prepare consumer-facing wallets

- Build tech to custody CBDC keys

- Maintain trusted security infrastructure

- Develop accompanying KYC and AML tools for digital payments transactions

- Develop new customer services and products

By looking at forms of digital currencies already in circulation, such as private stablecoins (digital currencies backed by fiat currencies and held at commercial banks), financial institutions can accumulate technical know-how by developing strategy, infrastructure, and products that support private stablecoins, ultimately helping support the future of CBDCs.

The digital road ahead

For any technology to gain widespread adoption, it must work for people in a variety of locales and contexts. As more central banks begin to actively explore CBDCs, financial institutions also need to invest in digital currency education, explore various use cases, and prepare their digital currency strategy.

Visa’s leading CBDC research, digital product capabilities and global network of merchants can support central banks in enabling CBDC to be seamlessly integrated with existing systems. Through our partnerships with both existing commercial banks and new digital wallet providers and exchanges, we are working with financial institutions to create secure, convenient and reliable digital solutions that can support CBDC from day one. The result? Minimal disruption to consumers and merchants and a new, exciting way for people to pay and be paid.

This article was first published by Visa in September 2021.

Catherine Gu

Global Central Bank Digital Currencies Lead, VisaCatherine Gu is Visa's global central bank digital currencies lead. Prior to Visa, she worked at Man Group and J.P. Morgan.

Visa

Visa is a global payments technology company that connects consumers, businesses, banks, and governments in more than 200 countries and territories, enabling them to use digital currency instead of cash and checks.