The project aims to leverage ADB and government funds to catalyze a multiple of green funds from private, institutional, and commercial sources over time. Photo credit: ADB.

Designed as a de-risking tool, this facility aims to leverage ADB and government funds to catalyze green funds from private, institutional, and commercial sources over time.

![]() ISSUE: Lack of a large-scale pipeline of bankable green infrastructure projects with impacts on Sustainable Development Goals.

ISSUE: Lack of a large-scale pipeline of bankable green infrastructure projects with impacts on Sustainable Development Goals.

Indonesia is one of the world’s top 10 greenhouse gas (GHG) emitters and accounts for more than half of GHG emissions in Southeast Asia. In the absence of rapid actions to address climate change, Indonesia will be increasingly exposed to severe climate disasters, leading to declines in livelihoods and food security, especially among the poorest and most vulnerable. Green growth, a common theme across many SDGs, needs to be central to Indonesia’s development, to preserve natural resources and achieve national SDG targets and climate pledges under the Paris Agreement. A key challenge for green infrastructure development is the scale of financing needed, estimated at $74 billion annually (climate-adjusted) during 2016-2020, with an annual infrastructure financing gap of about $51 billion. Furthermore, there is a lack of bankable green infrastructure projects, and the capacity of project sponsors and lenders in Indonesia to structure innovative finance solutions for better mitigation of project risks remains constrained.

![]() SOLUTION: Establish an integrated platform that leverages public resources to catalyze private funds and channel these into green infrastructure projects that will help achieve the SDGs.

SOLUTION: Establish an integrated platform that leverages public resources to catalyze private funds and channel these into green infrastructure projects that will help achieve the SDGs.

To help meet the SDGs, the Indonesian Ministry of Finance (MOF) launched Sustainable Development Goals (SDG) Indonesia One (SIO) in October 2018. Managed by PT Sarana Multi, SIO is a financing platform dedicated to accelerating achievement of the SDGs, one of the first such SDG platforms globally. It aims to catalyze funds through multiple windows—project preparation, de-risking, and equity investments—to achieve Indonesia’s SDG targets.

The ADB sovereign financial intermediary loan to Indonesia was approved in February 2022, to develop a Green Finance Facility (GFF) under SIO. Designed as a de-risking facility, the SIO-GFF aims to leverage ADB and government funds to catalyze a multiple of green funds from private, institutional, and commercial sources over time. The SIO-GFF mechanism will link funds provision to subprojects with clear green - a cross cutting theme across most SDGs - and financial bank-ability targets. The eligibility criteria for the identified indicative subprojects include guidelines on investment taxonomy; climate indicators (mitigation and adaptation core indicators including total tons of carbon dioxide to be avoided or reduced); environmental co-benefits (including improved biodiversity and air, water, and soil quality); and SDG performance indicators.

![]() HOW DID THE GFH AND ACGF HELP?

HOW DID THE GFH AND ACGF HELP?

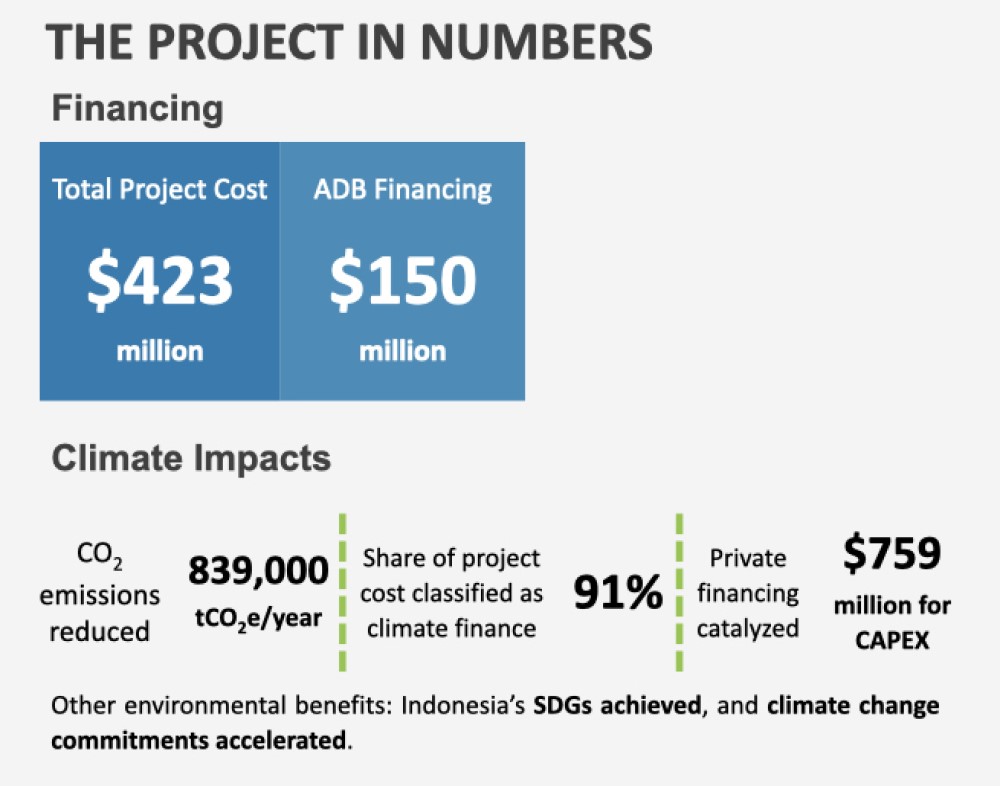

The ACGF, managed by SERD’s GFH, supported PT SMI in the development of the SIO Platform since its launch in 2018, co-leading the project origination, ideation, and financial structuring and design of the Green Finance Facility under SIO. Furthermore, the ACGF provided technical assistance between 2019 and 2021 to identify a pipeline of eligible subprojects worth approximately $423 million to receive funding under the SIO-GFF; help PT SMI improve business models and climate-related parameters of pipeline projects; build capacity in PT SMI on green and innovative finance; and define the green framework and climate change baseline for the program.

ADB: Asian Development Bank; CAPEX = Capital Expenditure; CO2 = Carbon Dioxide; SDGs = Sustainable Development Goals; tCO2 e: ton carbon dioxide equivalent.