Blue SEA Finance Hub

This flyer explains how ADB's Blue SEA Finance Hub aims to build a $300-million pipeline of bankable projects by 2024 to help ASEAN improve the sustainability of the region’s oceans ecosystems.

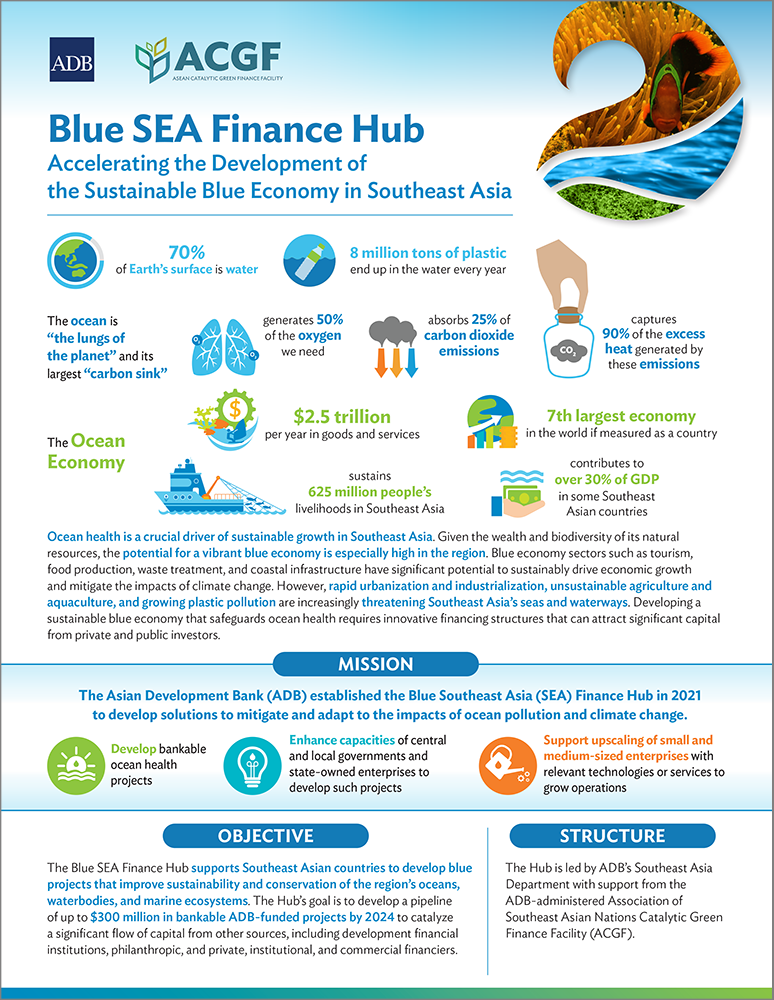

With 625 million people in Southeast Asia dependent on the ocean economy, ensuring marine resources are healthy is vital for the region.

This flyer explains how the Asian Development Bank's Blue SEA Finance Hub aims to build a $300-million pipeline of bankable projects by 2024 to help Southeast Asian countries improve the sustainability of the region’s oceans and marine ecosystems.

The hub plans to develop innovative finance structures that catalyze capital flows from private, commercial, and development finance investors. By targeting areas including sustainable aquaculture, coastal resilience, and ecosystem management, the initiative aims to mitigate the impacts of climate change and build a vibrant and healthy blue economy.

Published August 2023.