Charting the Future of Green Finance in Asia

Chief Industry and Government Affairs Officer, London Stock Exchange Group

Fund flows into environmental, social and governance investments in Asia and across the globe rose to $544.3 billion in 2020, more than double issuances in the previous year. Photo credit: ADB.

Encouraging trends have emerged that point toward the deepening of environmental, social, and governance agendas across the region.

This article is published in collaboration with the London Stock Exchange Group.

Sustainable financing has gained significant momentum in 2020 and regulators across Asia have stepped up efforts to promote the development of green finance and support the region’s transition to a sustainable future. For instance, the Monetary Authority of Singapore (MAS) announced in March that it will soon begin placing $2 billion to selected asset managers that are committed to deepen green finance activities out of Singapore, as part of its wider efforts to attract green funds and sustainability-focused asset managers.

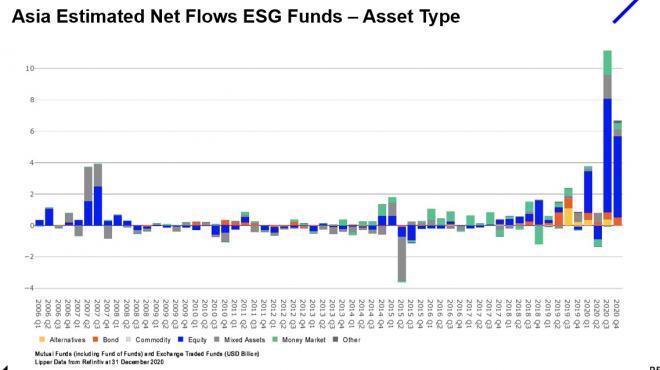

Fund flows into environmental, social and governance (ESG) investments in Asia and across the globe witnessed a sharp increase in 2020 compared to 2019, with Refinitiv’s Sustainable Finance Review indicating that sustainable finance bonds hit an all-time annual record of $544.3 billion in 2020, more than double the issuance levels in the previous year.

Similarly, data from Refinitiv Lipper shows that assets under management for ESG funds in Asia reached more than $60 billion in end-December 2020, doubling that of 2019.

As we approach the second half of the year, we see three encouraging trends for sustainable investment in Asia that point towards the deepening of ESG agendas across the region.

1) People’s Republic of China takes the lead

Asia-Pacific deal making involving sustainable companies accounted for 33% of mergers and acquisition activities in 2020 by deal value. Based on the number of deals, the People’s Republic of China (PRC) took the lead globally during this period, accounting for 20% of total sustainable deal-making activity globally, followed by the United States (9%), India and Italy (7%).

With sustainable investing becoming mainstream, the PRC has emerged as a pioneer in green finance, and its deepening green finance capabilities is an integral aspect of the recent 14th Five-Year Plan. The PRC represents one of the largest markets for green bonds, and it is home to a diverse array of other innovative green finance and ESG-themed products such as green funds, insurance products, exchange traded funds (ETFs), and asset-backed securities.

Alongside PRC’s national push to achieve carbon neutrality by 2060, regulators are also helping to accelerate the momentum for corporate ESG monitoring and disclosures in the PRC, with Chinese regulators beginning to detail the mandatory disclosure requirements for listed companies on their environmental information. PRC’s stock exchanges have also issued market guidance for ESG information disclosure.

Furthermore, there has been increase in voluntary ESG reporting among Chinese companies. Looking at the Chinese Securities Index (CSI) 300 companies, only 54% of them published annual ESG reports in 2013, but this has risen substantially to 85% of CSI300 companies in 2019. However, only 12% of those companies that disclose ESG data have audited reports, and the average scope and quality of ESG disclosures among CSI300 companies in the PRC are still lagging behind peers in the US and Europe.

2) Evolving green taxonomies

Sustainable finance taxonomies play an instrumental role in helping investors better identify sustainable business amid concerns over greenwashing and a lack of standardized ESG regulations and reporting.

The PRC published its green taxonomy (the Green Bond Endorsed Project Catalogue) in 2015, and its central bank announced in late March that it is cooperating with the European Union to push for greater convergence of taxonomies of green finance and investments across the two markets. The aim is to implement a jointly recognized classification system for the environmental credentials for businesses by the end of 2021.

Across the region, other Asian countries are also joining the green taxonomy trend. Malaysia is poised to launch a principles-based taxonomy this year after consultation with the market in 2020. The MAS recently published taxonomy proposals for financial services institutions in Singapore, which includes a traffic light system that helps to classify activities as green based on their level of alignment with environmental objectives.

More specific definitions for sustainable finance is important, and it would be ideal to harmonize these taxonomies and their underlying data set requirements across the region. Complete harmonization is always difficult, but a clear mapping of the underlying data sets which are the taxonomy’s building blocks to compliance is achievable and should be prioritized.

3) Green bonds go social

The range of green financing solutions available to investors has broadened significantly in recent years, with products such as Green ETFs, green private equity, green loans, as well as other listed and unlisted products hitting the market. Asia would do well to keep up, to innovate and to deepen liquidity in local markets for new green financing instruments.

Apart from green bonds, social bonds have also emerged as an alternative funding tool in Asia, useful in the fight against the pandemic by mitigating the socio-economic impact of the crisis. This was largely driven by an increase in capital-raising by sovereigns, multilaterals, and banks to support COVID-19 relief and recovery efforts. The proceeds allow issuers to raise funds for projects with positive social outcomes such as basic infrastructure, affordable housing, microfinance, food security and access to essential services.

According to Refinitiv’s data, Asia (excluding Japan) social bond issuance hit a record of $19.2 billion in 2020, nearly 20 times the total raised in 2019. The Philippines stood out in this arena as the largest social bond issuer (44%) in Asia ex Japan for 2020, followed by the People’s Republic of Korea (31%).

Plugging the data gaps

Despite the encouraging growth in sustainable investment, the lack of standardized, transparent and comprehensive ESG data and benchmarks to guide investment decisions remains one of the key obstacles among investors. According to the latest report by the Future of Sustainability Data Alliance (FoSDA), over eight in ten institutional investors globally cite data as the obstacle to effective assessment.

To help address this challenge, FoSDA announced the establishment of a Data Council in February 2021. By bringing together data providers including Refinitiv, S&P Global, Moody’s ESG Solutions Group, and other new members, the council aims to convene global data expertise to act as a much-needed industry and regulatory sounding board focused on establishing consensus on key ESG data issues and needs for a sustainable future. Data is critical to sustainable finance so the obstacles for investors need to be urgently removed.

Sustainability in a post-pandemic world

The COVID-19 crisis has heightened the focus on sustainable investing and underlined the urgent need to address ESG risks. Sustainable investing has made an irreversible leap into the mainstream, and there is greater awareness that robust ESG practices can help companies in Asia unlock new opportunities and attract new sources of capital in a post-pandemic environment.

With Asian markets poised to recover ahead of the rest of the world, the region’s green finance market will continue to grow and expand in the coming years. To help Asia’s sustainable finance ecosystem to flourish, greater clarity, collaboration and convergence among regulators, investors and other industry stakeholders are required to tackle underlying challenges and maintain this positive momentum for the long-term.

This article was first published by Business Times on 21 April 2021.

Sherry Madera

Chief Industry and Government Affairs Officer, London Stock Exchange GroupSherry Madera is chief industry and government affairs officer at the London Stock Exchange Group. She is also the chairperson of the Future of Sustainable Data Alliance.

London Stock Exchange Group (LSEG)

LSEG (London Stock Exchange Group) is a leading global financial markets infrastructure and data provider, playing a vital social and economic role in the world’s financial system.