This article was first published by BIMP-EAGA on 17 December 2020.

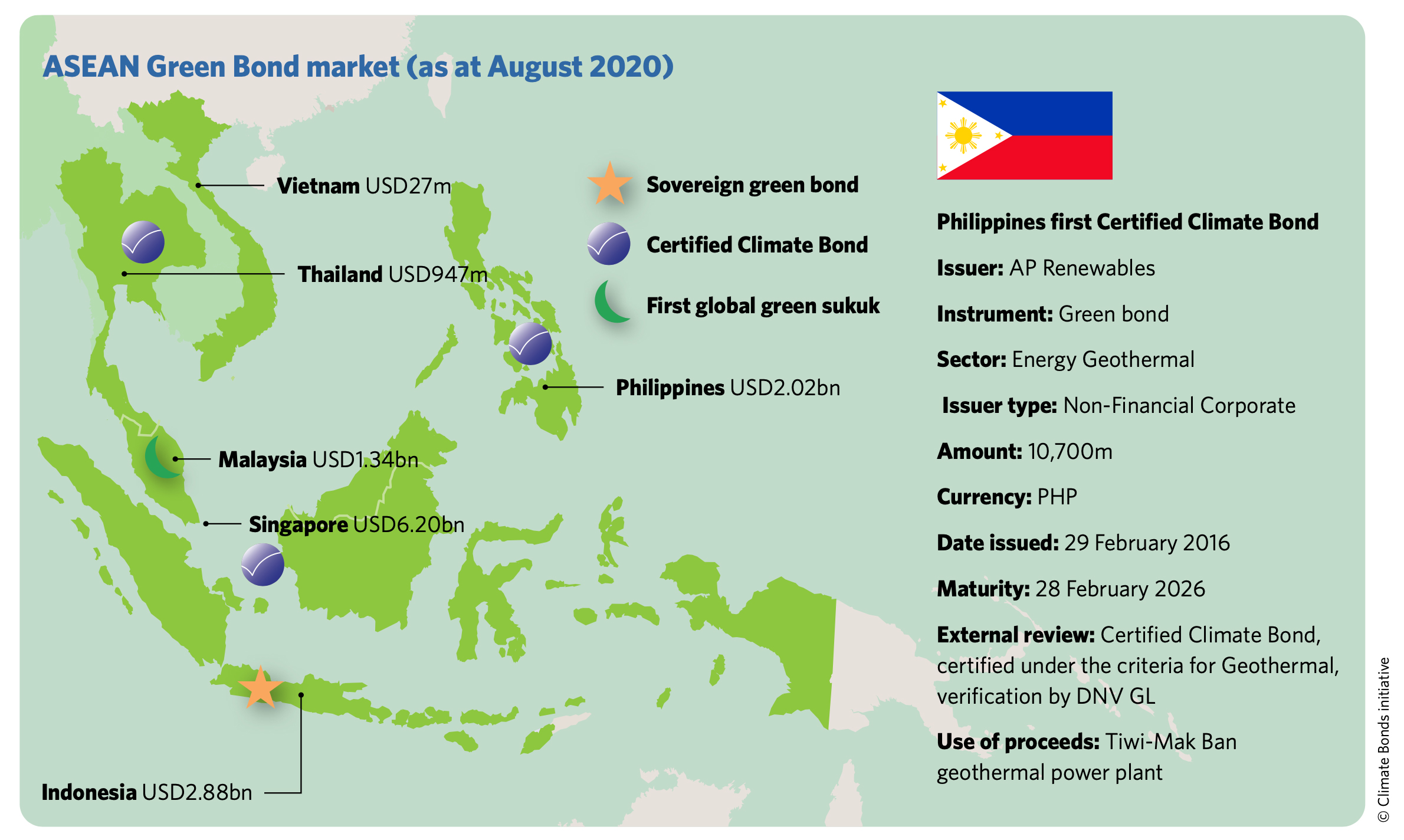

The Philippines is seeing green. It has raised more than $3 billion in green bonds and a growing portfolio of green infrastructure investments.

A new report from the Climate Bonds Initiative considers the Philippines as a leader in green finance in Southeast Asia because of these initiatives and for coming up with green equity instruments, credit guarantees, and guarantee funds, as well as specialty funds for green infrastructure and renewable energy.

The country has more than 70 projects in low-carbon transport, renewable energy, sustainable water, and sustainable waste management in the pipeline, with some already completed.

The Climate Bonds Initiative, an investor-focused not-for-profit that promotes large-scale investment in the low-carbon economy, cautions though that while there are growing opportunities in green finance and green infrastructure investment in the Philippines, stakeholders still need to do more to attract investors.

The Green Infrastructure Investment Opportunities Philippines 2020 Report, which is backed by the Asian Development Bank (ADB) and the Philippines’ Securities and Exchange Commission (SEC), recommends measures for enhancing green finance in the country. It also cites investment opportunities in clean energy (e.g., renewables, energy-efficient buildings), water management, mass transport, and solid waste management. It also notes that to attract more financing, the Philippines needs to come up with a strong pipeline of green projects.

Why go green?

The report notes that the Philippines is one of the world’s most climate vulnerable countries because of its high exposure to natural hazards, dependence on climate-sensitive natural resources, and vast coastlines. It cites the World Risk Report in 2019, which ranks the country as the 9th most vulnerable to disaster and climate change-related risk among the 180 countries examined.

“The significant scaling-up of investment in green infrastructure is critical for the Philippines to meet its climate commitments—including meeting global emission reduction pathways under the Paris Climate Change Agreement—and build resilience to the impacts of climate change as well as to achieve rapid economic development,” the report says.

The Philippine economy is expected to contract this year due to the fallout from the coronavirus virus (COVID-19) pandemic. The report says the government should use green finance to fund recovery efforts and to roll out green infrastructure projects to ensure sustainable growth while increasing the nation’s resilience to future shocks.

Green financing

Green financing

The report notes the potential of tapping green bonds to finance green infrastructure projects. “The growing level of interest from investors in green projects has resulted in the development and growth of innovative financial products including green, social, ESG [environmental, social, and governance] and sustainability bonds and loans; and green index products.”

It notes that green bonds may also finance projects to build back better in the wake of the pandemic. “In the future, green COVID-19 bonds may find a place in this list of themed green instruments.”

In the report’s foreword, SEC Commissioner Ephyro Luis B. Amatong says to date, total sustainable bond issuances stands at $3.4 billion equivalent—both on and off-shore—with 90% issued by local banks, renewable energy, infrastructure, and real estate companies. “This active and primary role of private sector green bond issuers dis-tinguishes the Philippines from other nascent green markets, where sovereign borrowers have played a more prominent first mover role. Indeed, in 2019, 10.6% of the total loan portfolio of the Philippine banking system went to finance green and social projects that were in line with the Sustainable Development Goals of the United Nations.”

Project pipeline

The report identifies more than 70 projects considered as green and potentially green. Some have already been completed. Projects were included on the list based on a specific set of criteria for screening green projects.

The transport sector has the biggest projects with the $12.9-billion North South Commuter Railway Project topping the list. Other big-ticket projects include the $7.4-billion Metro Manila Bus Rapid Transit Line 1, the $3.1-billion Metro Rail Transit (MRT) 4, the $1.5-billion MRT-11, and the $1.1-billion East–West Rail Project.

Among renewable energy projects, the $630.85-million Leyte-Luzon (Malitbog) Geothermal Power Plant is the biggest.

The $4.9-billion Clark Water Supply and Sewerage Project, meanwhile, is among the biggest projects in the sustainable water management sector.

The biggest sustainable waste management project is the $320-million Waste-to-Energy Facility Project in Cebu.

Greening Mindanao

The report identifies several green projects in Mindanao. These include the $807.5-million Ambal–Simuay River and Rio Grande de Mindanao River Flood Control Projects, the $659.2-million Kabulnan-2 Multipurpose Irrigation and Power Project, $383.1-million Davao Public Transport Modernization Project, the $618-million Davao People Mover Rail Project; and the $190-million Bubunawan Run-of-River Hydropower Project. The projects are in varying stages of development.

Two renewable energy projects have been completed. These are the $79.57-million Mindanao I Geothermal Plant and the $72.31-million Mindanao II Geothermal Plant.

The list also includes the Palawan Wind Farm in Vicente, Palawan. The project is still in the early planning stage.

Policy recommendations

Key policy measures are needed to spur the growth of green infrastructure projects and green finance in the Philippines. The report recommends the following measures:

- Incorporate climate risk exposure into new infrastructure plans, taking into account the impact of precipitation patterns, temperature increases, and extreme weather events on assets.

- Improve the visibility of green investment opportunities.

- Adjust regulatory requirements.

- Issue a sovereign green bond to kick-start a local green bond market and set benchmarks on pricing, liquidity, and set precedent.

- Promote the issuance of local government green bonds.

- Promote “COVID Recovery” bond programs that support a more sustainable recovery.

- Offer incentives, such as government-backed grants, to cover green bond issuance costs, subsidies for interest rates or third-party engagement, and/or launch incentives for issuers or investors, such as a tax-exemption to attract investors.

- Partner with development entities to leverage and reduce the risk of infrastructure projects and attract a wider range of investors.