Southeast Asian countries need to embrace digital technology and develop green capital markets to sustain their recovery from the coronavirus disease (COVID-19) pandemic, a ranking official from the Asian Development Bank (ADB) said.

In a keynote at the Asia Securities Industry and Financial Markets Association virtual meeting on 28 October, ADB Southeast Asia Department Director General Ramesh Subramaniam noted the challenges facing the region as the pandemic squeezed government resources, limiting budgets on meeting Sustainable Development Goals (SGDs) and climate change targets. “Green is the way forward to meeting many of these challenges,” he said at the event which was attended by some 180 participants from regional and global financial institutions.

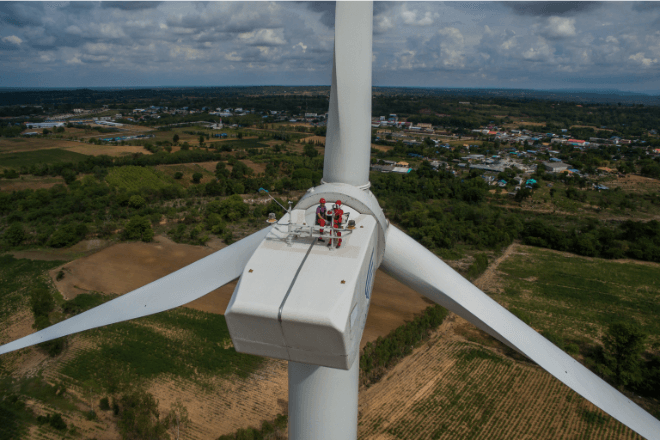

Green finance refers to all financing instruments, investments, and mechanisms that contribute to climate and environmental sustainability goals. It aims to reduce greenhouse gas emissions, boost climate resilience, and improve environmental protection, such as air and water quality, ecosystems, and biodiversity.

With Southeast Asian economies seen to shrink by 3.8% this year due to the pandemic, governments are faced with “large-scale revenue contractions as well as expenditure realignments,” which means less public funds available to spend on SDG-related investments, Subramaniam said. “This will undo decades of progress that the region has made in poverty alleviation.”

Huge climate change financing gap

Already, he said developing Asia is facing an annual financing gap of $460 billion for climate-resilient investments. “This challenge has just gotten worse now with less public funds being available and more risk perception at the private sector levels.”

He said tapping green capital markets is one of the ways the region could fill the financing gap, noting that in 2019, Asia Pacific countries raised $47.6 billion from green bonds alone, with the People’s Republic of China issuing close to half of the total at $22.9 billion. ASEAN countries have also tapped the green bonds market, with proceeds totaling $7.8 billion in 2019, while cumulative issuances since 2016 reached $13.4 billion. While there is growth, the total is still small, as it only accounts for 3% of global issuances and 16% of Asia Pacific’s. “This is clearly an area with significant potential for development as Asia with the exception of a few countries still accounts for a relatively small part of the global green and sustainability bonds market.”

He added, “Green finance through the capital markets will bring in both capital needed for SDGs or broadly sustainable investments but it will also bring in the rigor, the discipline, and the scrutiny that are so vital to ensuring SDG and ESG [environmental, social, and governance criteria] compliance by various entities as well as the projects that they'll be financing.”

Digitalization as a way to deliver SDG benefits

Coupled with green financing, Subramaniam said Southeast Asian countries need to look at technology as a way of delivering SDG benefits to the rural poor while supporting recovery from the pandemic.

“The potential for application of digitalization as we all know is limitless,” Subramaniam said.

He cited fintech, education technology, e-commerce, e-public governance systems, and

electronic cargo tracking among digital solutions with the most potential to spur inclusive growth. “These are vital in spreading out equitable growth from cities to rural areas while also decongesting cities and mitigating climate impacts.”

This article was adapted from a story that appeared on the SERD Newsletter published on 4 November 2020.